Key takeaways

- COVID-19 disrupted consumption and sales tax revenue: The pandemic caused historic declines in spending, threatening a major funding source for state and local governments.

- Wayfair expanded enforcement potential: States now rely on economic nexus to tax remote sellers, increasing scrutiny of out-of-state businesses.

- Accountants must prepare clients for audits: With shrinking local revenues, states will intensify enforcement—making proactive nexus reviews and compliance essential.

Never in our lifetimes have we witnessed a global, government-enforced shutdown of economic activity. Just the thought of such an action is, frankly, mind-boggling. The primary effort of governments and central banks is to spawn economic activity, but in this case we have been asked to curtail it. What will be the effect? How long can we expect the ramifications to ripple through our economy? What industries will be most affected? What is the impact on state and local tax revenues? What will be the effect on state and local budgets? These questions will be answered over the course of years, but at the forefront for many local communities is the immediate impact of lost sales on sales tax revenue.

The US Economy is Driven by Consumption

The United States economy was booming in 2019, with GDP hitting $21.4 trillion[1]. Personal consumption, the driver of the US economy, made up $14.56 trillion[2] or roughly 70% of the economy. Personal consumption was $4.5 trillion in goods and $10 trillion in services[3]. Personal consumption is primarily driven by individual income--the higher the income, the greater the consumption. Personal income rose to $18.6 trillion in 2019, with average individual income rising to $58,379.45 in the US[4]. Consumer expenditures are also influenced by future expectations as they relate to inflation, unemployment and income. This is a simplified view, but is a significant factor in why the US economy has performed so well in recent years. As of the beginning of 2020, the U.S. economy had seen uninterrupted expansion since 2009. The unemployment rate was near a 50-year low and the stock market was pushing towards a record high. These factors all contributed to increased consumption by the US consumer.

Economic Impact of COVID-19

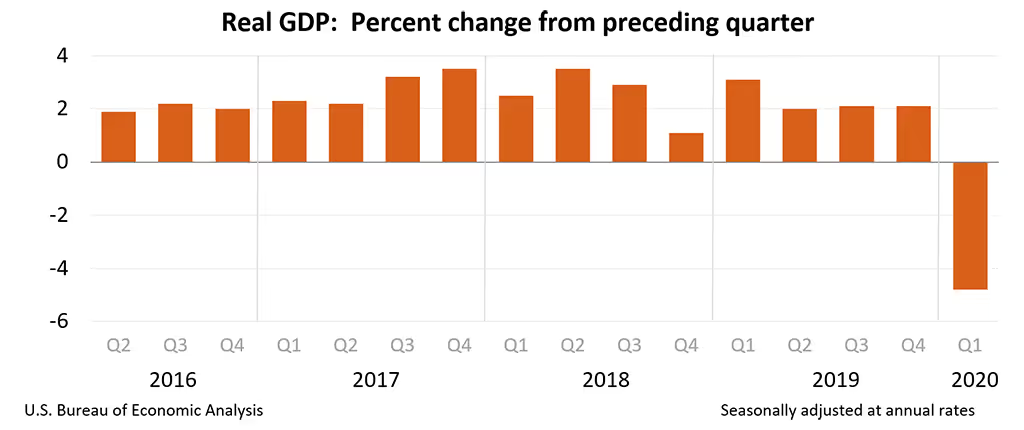

Enter the pandemic known as COVID-19. The resulting sudden and intense decline of the US economy is without historic parallel. The impact is staggering based on the early numbers. Unemployment claims rose by 22 million in April, raising the unemployment rate to 16.1% from 4.4%. US consumer spending plunged 7.5% in March, according to the Commerce Department, the sharpest monthly drop since 1959. Personal income fell by 2%, with wages and salaries falling by 3.1% due to the mass layoffs. The Government reported that GDP shrank at an annual rate of 4.8% for the first quarter[5]. Analysts are predicting the GDP will shrink by 40% in the current April-June quarter[6]. “We are looking at something quite grave,” said economist Janet L. Yellen, the former Federal Reserve chair. “If businesses suffer such serious losses and are forced to fire workers and have their firms go into bankruptcy, it may not be easy to pull out of that.”

Why is Sales Tax Important?

Sales tax provides state and local governments with valuable resources to serve their local communities. State and local governments rely on sales taxes as a significant portion of their overall budget. Specifically, sales taxes fund initiatives related to schools, roads, fire and police, and public transportation. Approximately $437 billion of sales tax was collected in 2019[7], representing about 35% of “own-source” state general revenue[8].

Forty-five states and the District of Columbia impose a general sales tax on goods and services (with some exemptions). Additionally, thirty-seven of these states impose a local sales tax at the County, City, and/or Municipality/Agency level. Sales taxes are broken into two categories that include general sales tax and selective sales tax. General sales tax comes from the sales of most goods and certain services. Selective sales taxes come from the sale of motor fuels, alcohol, and tobacco.

Impact on State Revenues

In past recessions, sales tax has been the most stable source of tax revenue for state and local governments because consumption behavior remains more constant than income levels. Expenditures are often subsidized by government assistance, unemployment benefits, personal savings, or other forms of non-taxable income. This is why sales tax revenues remain relatively stable during a downturn.

Today, given the reduction in physical retail, states are poised to aggressively enforce economic nexus laws. Audit departments, with the majority of in-state retail businesses shuttered, will shift from auditing local retailers to auditing out-of-state retailers who engage in their state[9].

Wayfair Implemented, Two Years Later

Governments are armed with fresh law. South Dakota vs Wayfair[10], the landmark Supreme Court decision issued on June 21, 2018, ruled that “economic nexus”, with some limitations, is sufficient for a state to enforce its tax regulations on out-of-state, or remote, sellers. The threshold model implemented in South Dakota includes a minimum of $100K in gross sales or 200 transactions before economic nexus is triggered, thereby requiring the business to collect and remit sales tax.

Remote/Online Sales Post Wayfair?

For state and local governments, there may be a silver lining to the loss of instate sales tax revenues as a result of COVID-19. Online spending, while growing at an incredible rate, still only represents roughly 11.0% of total retail sales, according to the Commerce Department retail data. Consumers spent $599.5 billion online with U.S. merchants in 2019, up 14.4% from $523.64 billion in 2018. Online transactions through businesses like Amazon, Walmart, Target, eBay, Etsy, and other marketplace facilitators are a nascent revenue source due to recent legislative changes. As this trend continues, state governments will have to tap into this commerce as a revenue source.

Enforcement Activity

It has taken a couple of years for states to get “Wayfair” legislation passed and the rules implemented. Most states have resorted to voluntary enforcement measures in this past year, but with the reduction of over-the-counter sales, states will be forced to examine their enforcement measures under Wayfair. It is reasonable to conclude that state enforcement efforts will get more aggressive as the second half of the year unfolds. Audit departments that used to spend a significant amount of time auditing local retailers prior to COVID-19, will shift their focus to out-of-state retailers that have been engaged in their state. Not only does this make logical sense, but it also makes fiscal sense for state and local agencies since the majority of their instate retail businesses have been shuttered.

Key Activities to Prepare Your Clients

Now, more than ever, the CPA community will be called upon to advise their clients. Post Wayfair, the AICPA has issued some thoughts on how firms must respond to the Wayfair decision and notify their clients to avoid potential professional liability. The AICPA outlines a 7-step plan for reducing this risk to the practice.

Many clients are battling to stay alive while others are thriving with an established online presence. Traditional brick-and-mortar companies will be looking to rapidly expand via e-commerce if they want to survive. Now is the time to prepare yourself and your clients for the eventual enforcement that will follow.

It is unlikely that state and local audit departments will engage in aggressive enforcement activities while the COVID-19 pandemic is still prevalent. More likely, audit departments will spend the next six months evaluating the best approach to expand their enforcement activities towards remote sellers. This is an eventuality, but the COVID-19 economic losses will force the timeline to accelerate. With the realistic expectation that in-state retailers sales will contract by as much as 60%, the governments have no choice but to look to the remote sellers engaged in business in their state.

As is readily apparent from the impact on state revenue sources due to COVID-19, you, the trusted advisor, must be prepared for upcoming enforcement actions. Economic nexus rules, lookback periods, transaction summations, counts, registration timelines, marketplace facilitator implications, and calculated exposure amounts must be thoroughly understood to properly protect your taxpayer client and minimize their overall risk. Using the LumaTax solution, you never have to worry about tracking all of these varying parameters to deliver this advisory service efficiently and effectively.

References:

- US Bureau of Economic Analysis, Table 5: Value Added by Industry Group,

- https://www.bea.gov/data/gdp/gdp-industry

- Ibid, Table 5

- Ibid, Table 5

- https://www.statista.com/statistics/216756/us-personal-income/

- https://www.bea.gov/news/2020/gross-domestic-product-1st-quarter-2020-advance-estimate

- https://www.cnbc.com/2020/04/30/us-personal-income-march-2020.html

- US Census Bureau, Quarterly Summary of State and Local Tax Revenue

- Own source revenue excludes intergovernmental transfers

- https://news.bloombergtax.com/daily-tax-report-state/businesses-urged-to-prepare-for-post-coronavirus-compliance-surge

- https://www.supremecourt.gov/opinions/17pdf/17-494_j4el.pdf

Frequently asked questions

New Year's Day - 1/1/2024Memorial Day - 5/27/20244th of July - 7/4/2024Labor Day - 9/2/2024Thanksgiving Day - 11/28/2024Day after Thanksgiving - 11/29/2024Christmas Eve - 12/24/2024Christmas Day - 12/25/2024

How did COVID-19 affect state and local tax revenues?

The pandemic caused a historic decline in consumer spending and retail activity, leading to major drops in sales tax revenues — a key funding source for schools, infrastructure, and public services.

Why are states focusing more on remote sellers?

With many physical stores closed, states are turning to economic nexus laws under the Wayfair ruling to ensure out-of-state online sellers collect and remit sales tax on transactions within their borders.

What should accountants and businesses do to prepare?

Businesses should review their nexus exposure, registration timelines, and sales data across states. CPAs can use tools like LumaTax to identify compliance risks and help clients meet new enforcement demands efficiently.